- No Drift

- Posts

- The Freedom Gap: Why You’re Broke and How to Fix It Forever

The Freedom Gap: Why You’re Broke and How to Fix It Forever

The money you waste today steals freedom from your future. Here’s how to take back control of your life and build real financial independence—starting now.

If you’re broke, you’re not free. Your time isn’t yours. Your choices aren’t yours. And every day you stay stuck, you’re trading your future freedom for temporary comfort. But here’s the truth—you can fix this, and it starts right now.

Why Most People Stay Stuck

Most people waste their money. They go to work every week, complain about having to work, and then spend their hard earned money things that bring them short-term pleasure. Alcohol, smoking, drugs, food, gambling, and clothes are the worst offenders.

They also buy more expensive stuff on finance like a flashy car or package holidays to escape the mundanity of their lives or to signal to others that they’re high status when the sad truth is that this couldn’t be further from the truth.

And the craziest part of all of this? They will often pay for these things using high interest credit cards & loans. So not only are they wasting the initial amount when they buy stuff, they’re also paying loads of interest on the stuff they wasted their money on. It makes no sense if you step back look at it rationally.

They have no plan. They simply exist, living from one moment to the next, avoiding responsibility & distracting themselves from the reality of their situation. This is no way to live & will not result in being able to live a life of true freedom.

How To Avoid Being Most People

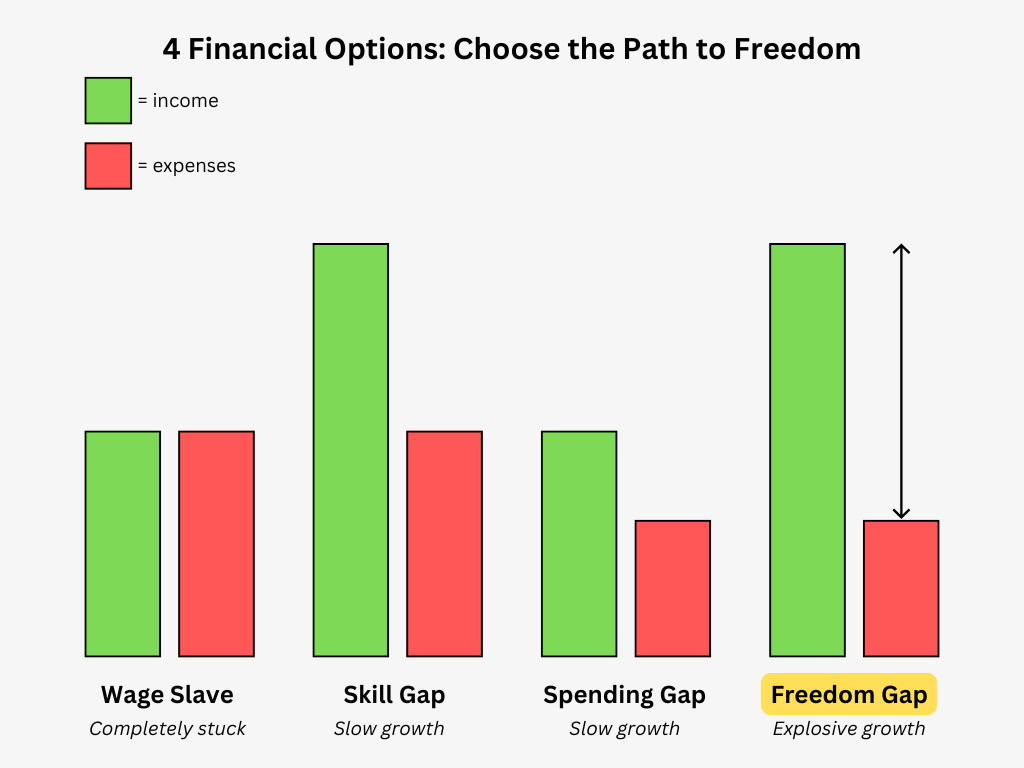

There are two things you need to focus on when it comes to building wealth:

Making more money

Spending less money

You can just do one. But if you want to escape the cycle faster, the real magic happens when you do both at the same time. You make more, you spend less, and the gap in between becomes the fuel for your future freedom.

The Freedom Gap - “when you earn more, spend less, and use the difference to build wealth.”

How To Make More Money

The single best way to make more money is to learn high income skills. Think sales, copywriting, coding etc. These will allow you create more leverage aka you’ll be getting paid more for working the same amount of time.

And if you’re now wondering what the best way to learn high income skills is… Go find a few expensive courses or programmes that teach you the skill, do some research on the companies to make sure they’re legit (e.g. TrustPilot reviews), and then buy the one that your heart is telling you to go with.

From here you’ll be able to improve at the skill, connect with other people who are also on a similar journey, and even leverage the connections you make to find yourself a role where you can use your new skill & start making Benjamins.

There is another way that’s less attractive, but very practical. You can just work more hours, either at your current job or get another job on the side. Sacrifice your evenings or your weekends temporarily & you’ll be able to buy your way towards freedom much faster. Giving up that extra time for 6 months might suck, but those months will buy you years of freedom.

How To Spend Less Money

I want to start by saying that having a scarcity mentality is bad. Money is abundant. Trillions of dollars are spend every single day around the world. Spending too little money is almost as bad as spending too much. Balance is key.

The aim of all of this is to end up with an abundance of money being generated by assets you own that you can spend to your heart’s content without risking your future. And right now our objective is to get to that point as quickly as possible. Hence the temporary reduction of unnecessary spending.

The low hanging fruit is cutting out expensive consumables like alcohol, drugs, smoking, vaping, and ordering food. I understand why people buy these things. They distract you from the reality that is your life. But it’s a short term solution for a long term problem. So cut them out.

Next up is downgrading. If you have an expensive car that sucks hundreds out of your back account every month, get rid of it. Get a cheap, reliable car instead. If you like buying expensive clothes from big brands, stop. Buy high quality essentials that last.

Again, I want to be clear that this is not how you should behave forever. I want a cool car & nice clothes. But I refuse to buy them until I’ve built wealth. Then I can enjoy them knowing I truly earned them.

That has to feel better than buying them to impress people who don’t actually give a shit about what you do & putting yourself in a bad financial position to do so. You’re not being cheap—you’re being smart. And everything you save now is a weapon against being stuck forever.

Big Charlie with the financial sauce

What To Do With Your Money

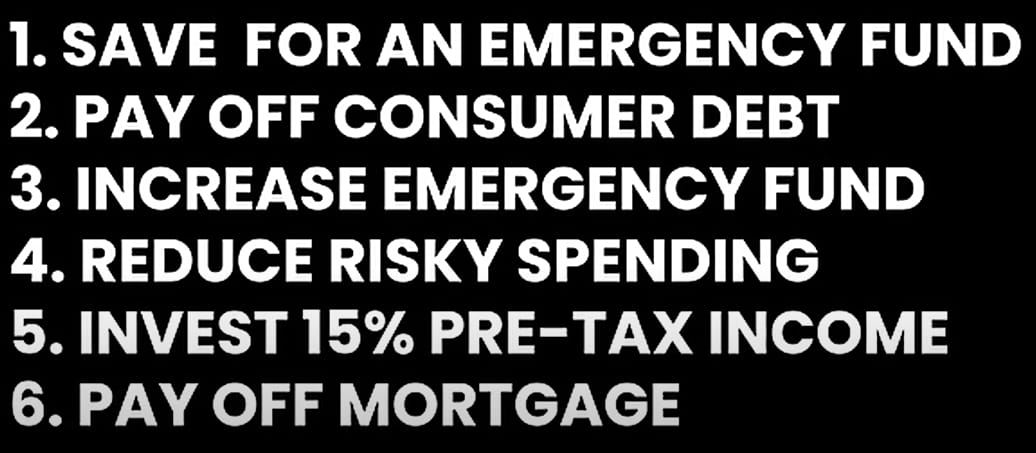

If you’ve followed the steps so far… congratulations. You’re now on track getting your shit together & building a life of freedom. Now for the golden question of what you should do with all your spare money. There’s a very simple, highly effective process I’d recommend following. It’s an adapted version of Dave Ramsey’s 7 Baby Steps:

Save an Emergency Fund: Start with £1k as your immediate safety net.

Clear High-Interest Debt: Credit cards, payday loans—these are freedom killers. Pay them off fast.

Build Your Emergency Fund to £10k: This gives you security and options. Keep it in a high-interest, easy-access account.

Clear All Remaining Debt: Eliminate every financial chain holding you back.

Start investing 25%-50% of your income in Index Funds: Put your money into the funds like the S&P 500—for simple, consistent growth over time.

Allocate 25% of your income to Learning High-Income Skills: Double down on the skills that will increase your income and multiply this process.

Save the remaining 25% of your income in cash: Keep this in a high-interest account as a house fund—buy something affordable, not flashy.

Enjoy What’s Left—But Be Smart: Spend intentionally and understand the long-term cost of every decision.

From a recent Alex Hormozi video that inspired this newsletter

Why It’s Worth It

Imagine waking up and doing exactly what you want—not what you’re forced to do.

You have:

Assets that grow while you sleep.

Skills that make you valuable in any situation.

Money saved for emergencies and opportunities.

You’re no longer trading your time for money. You’ve bought back your life.

This is the life I dream of—and the life I’m working toward.

Will you join me? Will you take control of your finances, follow these steps, and build the freedom you deserve?

Because here’s the truth: every sacrifice you make today is an investment in the life you’ve always wanted.

So you’re ready to live differently, start today.

Cut out the waste.

Focus on earning and saving.

Put every pound, dollar, or euro to work for you.

Your freedom is waiting. The choice is yours.

Freedom is king.