- No Drift

- Posts

- The Freedom Gap: The Secret to Building Wealth and Escaping the 9-to-5 Grind

The Freedom Gap: The Secret to Building Wealth and Escaping the 9-to-5 Grind

A Simple Yet Powerful Formula to Build Wealth, Gain Freedom, and Escape the Grind for Good.

The Freedom Gap

What if your life didn’t revolve around a 9-to-5 grind, endless bills, and weekends that pass way too fast?

Imagine waking up knowing you’re free to design every moment of your day. A life where money is no longer a source of stress, where you’re free to spend your time as you choose, and where the world truly feels like your oyster.

I’m going to give you the exact roadmap to achieve this.

This isn’t theory or fluff—it’s a proven system to create a life of wealth, fulfilment, and freedom. By the time you’re done reading, you’ll know exactly how to bridge the gap between where you are and where you want to be.

This is the same system that took me from working a dead-end sales job, earning minimum wage, to being on track to make £200k this year from anywhere in the world—all in just under 18 months. And the best part? I’m just getting started.

I used to sit at my desk feeling completely lost, dreaming of a life of freedom and purpose. I knew I could get there, but I had no idea how to start.

Looking back, it’s clear what I could have done to get here faster. And that’s exactly what I’m going to show you today.

Let’s start with the core concept that will drive everything else: The Freedom Gap.

What is the Freedom Gap?

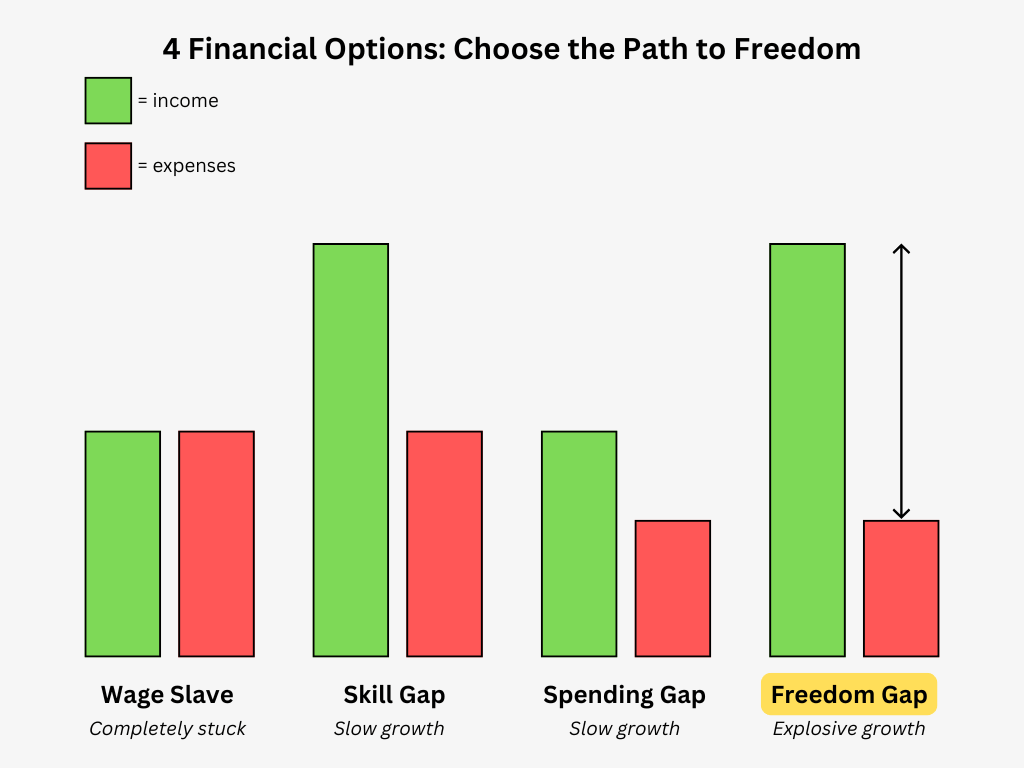

The Freedom Gap is the space between your income and your expenses. This gap is the lifeblood of financial freedom, and expanding it should be your primary focus. You do this by increasing income, decreasing expenses, or, ideally, both simultaneously. The third option is the most effective and should be your ultimate aim.

Once you’ve created a meaningful Freedom Gap, the next step is leveraging it to build a life of freedom. This is where the journey becomes exponential. Your early efforts may feel like a grind, but as your skills and income grow, progress compounds. Success builds on success, creating a snowball effect that accelerates your journey.

From my original newsletter that introduced the idea of the “Freedom Gap”

Stage 1: Build Your Financial Baseline

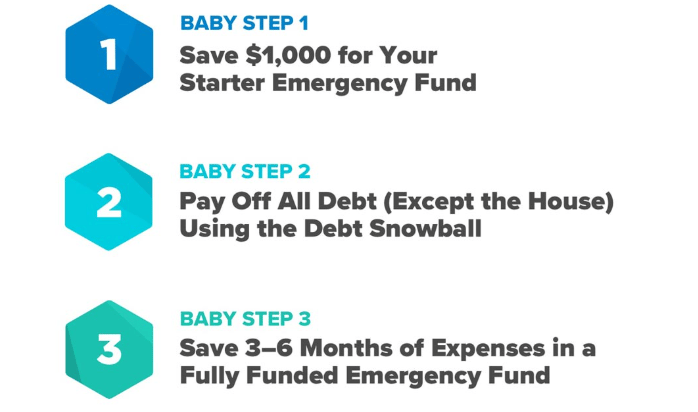

The first step after creating a Freedom Gap is to establish financial stability. Think of this as your foundation. Without it, everything else is at risk of collapse. Follow these three steps:

Save £1,000 for emergencies. This is your immediate safety net for unexpected expenses. It’s not much, but it will prevent small crises from derailing your progress.

Eliminate high-interest debt. Credit card balances, payday loans, and other high-interest obligations are like financial quicksand. Dig yourself out as quickly as possible.

Save 3-6 months of expenses. This becomes your baseline. Treat it as untouchable. It’s the new "zero" in your bank account. Unless you’re facing a true emergency, you do not dip below this level—ever.

This baseline is your fortress, giving you the stability to take calculated risks and seize opportunities.

From Dave Ramsey’s 7-Baby Steps which has helped millions get their shit together financially.

Stage 2: Invest in High-Income Skills

With your baseline secured, it’s time to use your Freedom Gap strategically. The best investment you can make is in yourself, specifically in developing high-income skills.

Why? Because skills are leverage. The right skill can exponentially increase your earning potential, allowing you to widen your Freedom Gap even further.

Mentorship is non-negotiable. Skip the DIY route. Invest in coaching from experts in your chosen field. Here’s why:

Tailored learning: A mentor aligns their guidance with your strengths, weaknesses, and goals.

Faster progress: Instead of wasting months or years on trial and error, you’ll learn what actually works.

Access to networks: A good mentor doesn’t just teach you; they connect you with opportunities.

Choose a skill that aligns with your temperament and innate talents. For example:

If you’re an extrovert, consider sales or public speaking.

If you’re an introvert, copywriting or coding might be a better fit.

Your first investment might feel like a stretch, especially if your Freedom Gap is still small. But trust me, it’s worth it. This is the grind stage. Push through, and it will pay off exponentially.

Stage 3: Avoid the Lifestyle Inflation Trap

As your income grows, so will the temptation to spend more. New car? Bigger apartment? Flashy holidays? It’s all so tempting, but this is a trap. Lifestyle inflation is the silent killer of financial freedom.

Here’s the rule: Keep your expenses stable as your income grows. The bigger your Freedom Gap, the faster you can invest in even higher-value skills and assets.

The time for Lambos & jet skis will come—but not yet.

For those unable to afford a Bugatti.

Stage 4: Repeat and Scale

Once you’ve successfully learned a high-income skill and increased your earning potential, the next step is to reinvest in yourself.

Use your newfound income to widen your Freedom Gap even further by learning even more valuable skills. Each time you reinvest, your growth becomes exponential.

The process compounds: the more skills you acquire, the greater your earning power becomes. You can repeat this process as many times as you like, each time widening your Freedom Gap even further.

Over time, you’ll be earning enough to live your dream life, with plenty left over to invest in assets, experiences, or even give generously to causes you care about. This is the ultimate path to true financial independence and freedom.

Stage 5: Define Your Freedom Formula

At this stage, your focus shifts from grinding to optimising. The ultimate goal is to achieve a lifestyle where you:

Work 0-10 hours per week

Operate from anywhere in the world.

Earn 2-4x the cost of your dream lifestyle.

This is the Freedom Formula: the sweet spot where time, money, and location independence converge. Use your Freedom Gap to get there.

Stage 6: Master Multiple Disciplines

The skills you’ve learned so far are just the beginning. Remember, it’s not just financial skills that can be learned exponentially faster with mentorship. You should invest in coaching or mentorship from experts in any area of life you want to improve. Whether it’s fitness, writing, cooking, or public speaking, paying for expertise allows you to bypass years of trial and error and make rapid progress.

Some skills act as force multipliers, enhancing other areas of your life. For instance:

Going to the gym builds strength and discipline, which can improve your focus and energy for work.

Learning how to write effectively sharpens your communication, making you more persuasive in business and personal relationships.

Mastering a martial art boosts confidence, which translates into better performance in high-stakes situations like sales or negotiations.

Every skill you acquire compounds your growth, making you greater than the sum of your parts. The investment you make in learning multiple disciplines pays dividends not only in financial terms but across every dimension of your life.

Be the person who can do it all.

Time is Finite, Money is Unlimited

Here’s the ultimate truth: Time is your most valuable resource. Money, on the other hand, is effectively unlimited. Always trade money for time when it makes sense, especially when that time can be used to acquire skills that create more wealth.

By leveraging the Freedom Gap, investing in yourself, and compounding your growth through multi-disciplinary learning, you’ll create a life that exceeds your wildest dreams.

The process is simple, but it requires discipline and commitment. For those who understand and act on these principles, the rewards are nothing short of extraordinary.

The path to freedom is simple, but it’s not easy. If you’re ready to face the adversity, stay disciplined, and embrace the journey, you can achieve anything.

An absolute gem from Hormozi to finish with.